knoxville tn sales tax calculator

Local sales tax is 225 of the first. The County sales tax rate is.

When it comes time to file sales tax in Tennessee you must do two things.

. 85 sales tax in Johnson County You can use our Tennessee sales tax calculator to determine the applicable sales tax for any location in Tennessee by entering the zip code in which the purchase takes place. 2021 cost of living calculator for taxes. The following information is for Williamson County TN USA with a county sales tax rate of 275.

Food in Tennesse is taxed at 5000 plus any local taxes. Kingsport TN 37660 Phone. Tax day is a time for celebration in the Volunteer State as.

Sales Tax State Local Sales Tax on Food. Tennessee sales tax returns are always due the 20th of the month following the reporting period. 064 average effective rate.

You may also be interested in printing a Tennessee sales tax table for easy calculation of sales taxes when you cant access this calculator. The base state sales tax rate in Tennessee is 7. None 1 flat tax on interest and dividends earned in tax year 2020 Sales tax.

The Clerk and Master will open the bidding process with the total due on the property for delinquent taxes through the 2012 tax year interest penalty fees and other cost associated with the sale owed to the City of Knoxville Tennessee and Knox County Tennessee. Knoxville is in the following zip codes. Monday - Friday 800 am - 430 pm Department Email.

Sales Tax Breakdown Knoxville Details Knoxville TN is in Knox County. Box 70 Knoxville TN 37901 Phone. See the State tax list PDF for rates in your citycounty.

2022 Cost of Living Calculator for Taxes. None 1 flat tax on interest and dividends earned in tax year 2020 sales tax. Mailing Address Knox County Trustee PO.

Assessment Tax Rate. Wayfair Inc affect Tennessee. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945.

Real property tax on median home. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in South Knoxville Knoxville TN. 1600 x 225 local sales tax 36 1600 x 275 Single Article tax rate 44 Total tax due on the vehicle 1851 if purchased in Tennessee Minus credit for 1518 FL sales tax paid must be on bill of sale 333 tax still due at time of registration.

M-F 8am - 5pm. There is no applicable city tax or special tax. Tennessee State Tax Quick Facts.

Johnson City TN 37601 Knoxville TN 37914 423 854-5321 865 594-6100. For tax rates in other cities see Tennessee sales taxes by city and county. If the filing due date falls on a weekend or holiday sales tax is generally due the next business day.

37901 37902 37909. File a sales. County Appraisal Calculate.

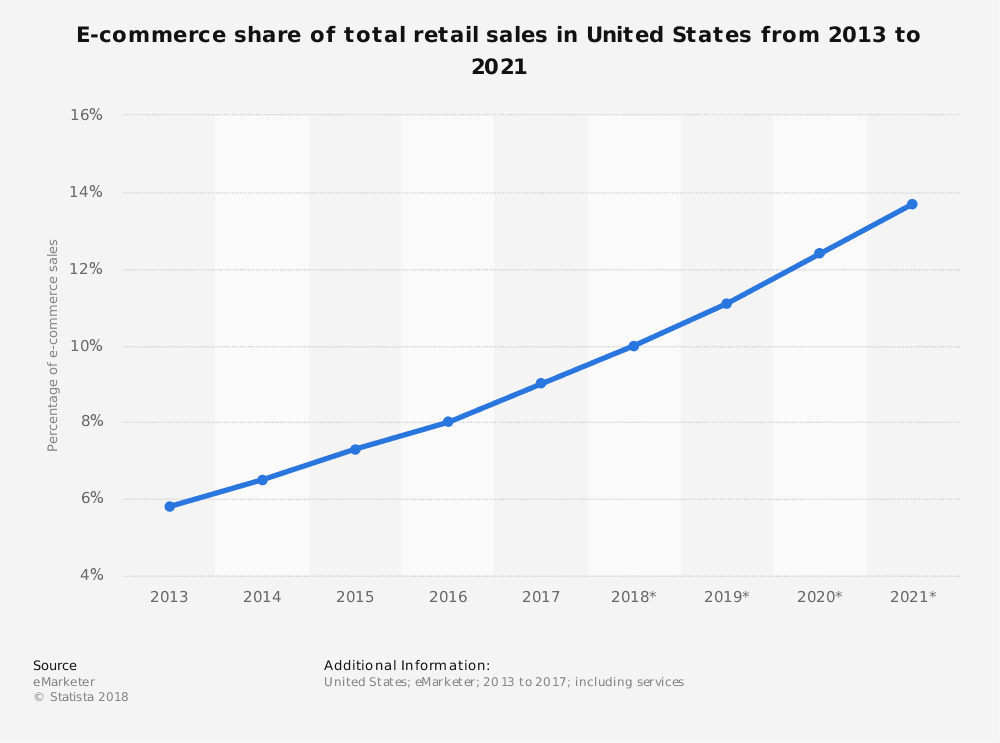

Did South Dakota v. Monday through Friday and is located in suite 453 of the City County Building 400 Main Street in downtown Knoxville. Knoxville TN Sales Tax Rate Knoxville TN Sales Tax Rate The current total local sales tax rate in Knoxville TN is 9250.

The Knoxville sales tax rate is. 225 West Center St. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

The Tennessee sales tax rate is currently. You can print a 925 sales tax table here. Tennessee Sales Tax - Small Business Guide Truic.

Other counties in TN may have a higher or lower county tax rate applied to the first 1600. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Knoxville TN. With local taxes the total sales tax rate is between 8500 and 9750.

The December 2020 total local sales tax rate was also 9250. Tennessee has recent rate changes Fri. 05 lower than the maximum sales tax in TN The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax.

700 Tennessee State Sales Tax -425 Maximum Local Sales Tax 275 Maximum Possible Sales Tax 945 Average Local State Sales Tax. Tennessee sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Tennessee sales and use tax rule 1320-05-01-03 Charges made by a dealer to customers for title fees are considered pass through charges excludable from the sales price of the.

Knoxville TN 37902. TN Auto Sales Tax Calculator. This is the total of state county and city sales tax rates.

Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975 Tennessee has 779 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Find your Tennessee combined state and local tax rate. 26 cents per gallon of regular gasoline 27 cents per gallon of diesel.

The following information is for williamson county tn usa with a county sales tax rate of 275. Enter zip codeof the sale location or the sales tax ratein percent Sales Tax Calculate By Tax Rateor calculate by zip code ZIP Code Calculate By ZIP Codeor manually enter sales tax Tennessee QuickFacts. Local tax rates in Tennessee range from 0 to 3 making the sales tax range in Tennessee 7 to 10.

The minimum combined 2022 sales tax rate for Knoxville Tennessee is. 400 Main Street KnoxvilleTN 37902. Tennessee TN Sales Tax Rates by City K The state sales tax rate in Tennessee is 7000.

Property taxes can be paid by mail to PO. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property. Calculate how much sales tax you owe.

Littleton Colorado and Knoxville Tennessee. Knoxville tn sales tax calculator. The highest the combined citycounty rate can be is 275.

Box 15001 Knoxville TN 37901-5001 or in person at the downtown Property Tax Office The downtown Property Tax Office is open from 8 am.

Cost Of Living In Knoxville Tn 2021

North Dakota Sales Tax Rates By City County 2022

Tennessee Income Tax Calculator Smartasset

Tennessee County Clerk Registration Renewals

Tennessee County Clerk Registration Renewals

Tennessee Car Sales Tax Everything You Need To Know

Sales Tax On Grocery Items Taxjar

The Ultimate Guide To Tennessee Real Estate Taxes

Tennessee Sales Tax Small Business Guide Truic

Kentucky Property Tax Calculator Smartasset

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Tennessee Sales Tax Calculator Reverse Sales Dremployee

Tennessee Taxes Do Residents Pay Income Tax H R Block

Tennessee Income Tax Calculator Smartasset

3 Things You Need To Know About Internet Sales Tax After Wayfair Red Stag Fulfillment

Tennessee Income Tax Calculator Smartasset