ny estate tax exemption 2022

You may need to report this information on your 2021 federal income tax return. Gifts made in the three 3 years prior to death are subject to claw-back and included in the calculation of the NYS gross estate.

Lifetime Qtipable Trusts For Gift Estate Tax Exemption Planning New York Law Journal

The current New York.

. New York has an estate tax exemption of 5930000. This means that when someone dies and. In case the property value is 6 million there is a 70000 taxable overdue.

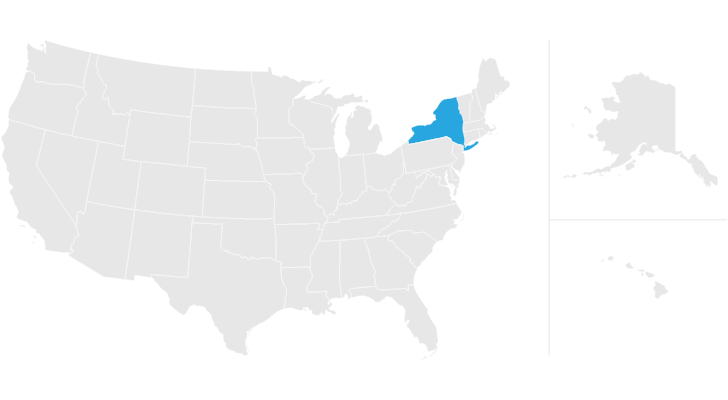

Town city village county and. For people who pass away in 2022 the Federal exemption amount will be 1206000000. New york estate tax exemption the new york estate tax threshold is 592 million in 2021 and 611 million in 2022.

In other states the estate would pay a tax based on. For more information see the General Information section and the instructions for lines 13 and 26 on Form ET-706-I and also TSB-M-19-1E. New York Estate Tax.

Common property tax exemptions. When you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount Federally or the basic exclusion amount in New York State. Despite the large federal estate tax.

The New York States estate tax exemption for 2022 is 6110000 million. The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019. You can find all the details on tax rates in the Revenue Procedure 2021-45.

New York has an estate tax exemption of 5930000 for 2021. Even if a deceaseds estate is not large enough to owe federal estate tax individuals may still owe an estate tax to the state of New York. Only a small minority of families will have to pay estate taxes to the federal government after a loved one dies.

The maximum Federal tax rate is 40. 2022 New York State Estate Tax Exemption. New York Estate Tax Exemption.

This means that a New Yorker passing away with more than the exemption amount or a non NY resident with tangible or real property in NY in excess of the exemption must pay a. STAR School Tax Relief Senior citizens exemption. Ad From Fisher Investments 40 years managing money and helping thousands of families.

Despite the large Federal Estate Tax exclusion amount New York States estate tax exemption for 2021 is 593 million. In 2022 the New York estate tax exemption is 6110000 up from 593mm in 2021. No portability in NYS.

Trusts and Estate Tax Rates of 2022. Of all the states Connecticut has the highest exemption amount of 91 million. The assessors notice must specify the difference in the indicated total full value estimates of the locally stated level of assessment and the tentative equalization rate for the taxable property within each affected jurisdiction listed above.

Exemptions for agricultural properties. The amount of the estate tax exemption for 2022. Real Estate Transfer Tax Forms.

New York State still does not recognize portability. Exemption for persons with disabilities. The estate tax rate is based on the value of the decedents entire taxable estate.

Here is what you need to know. For people who pass away in 2022 the Federal exemption amount will be 1206000000. It is anticipated to be a little over 6 million in 2022.

The tax rate ranges from 116 to 12 for 2022. In New York for the year 2022 a single persons estate is subject to tax beyond what New. The New York estate tax exemption equivalent increased from 593 million to 611 million effective January 1 2022 but continues to be phased out for New York taxable estates valued between 100 and 105 of the exemption amount with no exemption being available for taxable estates in excess of 105 of the exemption amount.

If someone dies in September 2022 leaving a taxable estate of 7 million the estate would exceed the New York exempt amount 6110000 by 890000. The assessor must provide this notice within ten. The IRS recently announced inflation adjustments for the 2022 tax year with Estate Tax rates and Trust tax.

For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. New York State does not recognize portability so unlike federal law which enables a surviving spouse to make use of the deceased spouses unused estate tax exemption New York law requires some extra planning. But as we illustrated above a much larger group of people may be at risk of losing wealth to the State of New York through its uniquely structured method of taxing the entirety of.

Up to 25 cash back The New York Estate Tax Cliff By contrast New York taxes the entire value of an estate that exceeds the exemption by more than 105. It means that if a New York resident passes away having an estate of 5930000 in 2021 100 of the legacy will pass to the heirs without any New York state tax due. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025. Take a look at the table below. The federal estate tax exemption in 2022 is 1206 million high enough not to worry most Americans thinking about passing assets to the next generation of family.

In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax. As of the date of this article the exact exclusion amount for 2022 has not been released. New Yorks estate tax law has a significantly lower threshold.

The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation-adjusted. 16 rows What is the current exemption from New York estate tax again. This means that if a persons estate is worth less than 611 million and they die in 2022 the estate owes nothing to the state of New York.

The existing per-person New York state estate April 18 2022 New Yorks estate tax cliff can lead to heirs in the state paying estate tax at a rate that surpasses 100. New York is one of the states that administers their own NY estate tax and has a relatively low NY estate tax exemption amount. New York estate tax update for 2022.

For a list of available property tax exemptions in New York State see Assessor Manuals Exemption Administration Part 1. Starting in 2023 it will be a 12 fixed rate. The current estate and gift tax exemption of 2022 is 1206000000 or 2412000000 for a couple.

The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019. In 2022 the New York estate tax exemption is 6110000 up from 593mm in 2021. No NYS gift tax.

The existing per-person New York state estate tax exemption is 611 million. Commencing January 1 2022 the New York State Estate Tax Exemption per person. The connecticut state gift estate tax exemption has increased from 71 million in 2021 to 91 million in 2022.

For previous periods see information for dates of death on or after February 1 2000 and before April 1 2014. In 2022 the law assesses no taxes on an individual taxable estate of less than 12000000. Effective January 1 2022 the BBBA reduces the.

For a married couple that comes to a combined exemption of 2412 million. The New York estate taxthreshold is 592 million in 2021 and 611 million in 2022. That number will keep going up annually with inflation.

The BBBA proposal seeks to reduce these. The New York estate tax exemption amount is currently 5930000 for 2021. Although the top New York estate tax rate.

Gift Tax Explained 2021 Exemption And Rates

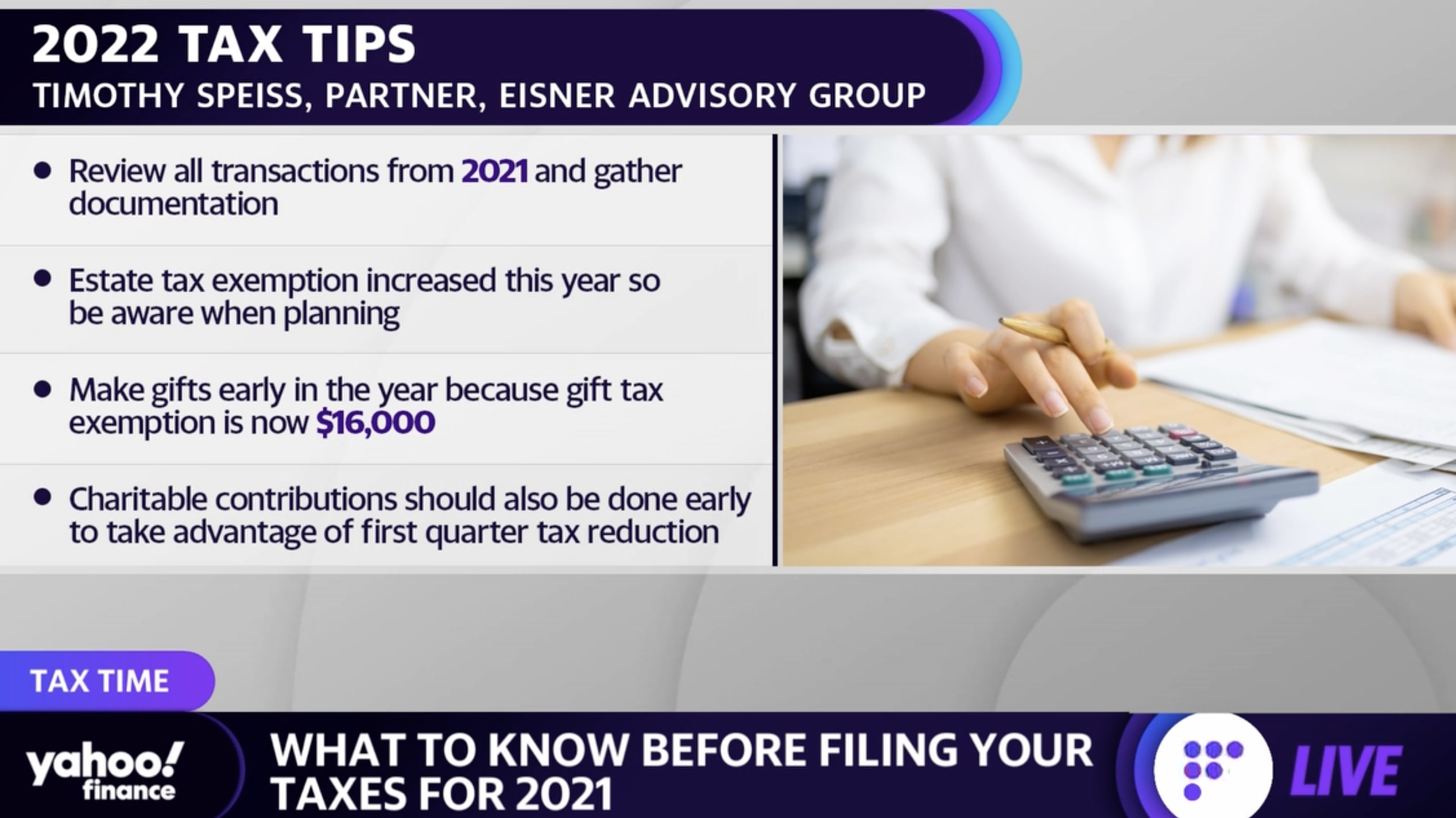

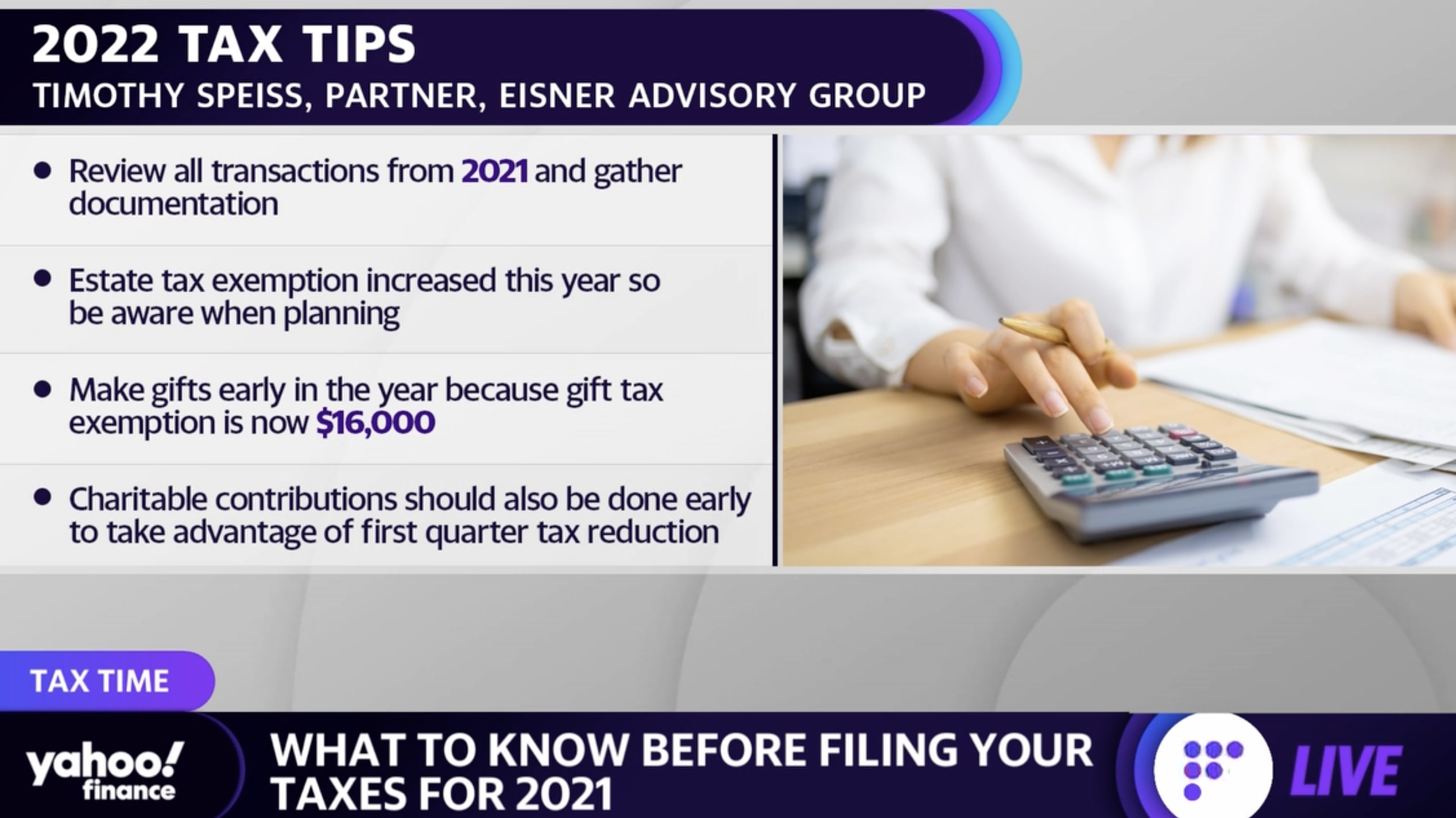

Taxes 7 Tips To Prepare For The 2022 Tax Season

Warshaw Burstein Llp 2022 Trust And Estates Updates

Income Tax Brackets 2022 Which Are The New Tax Figures And Changes You Need To Know Marca

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

New York S Death Tax The Case For Killing It Empire Center For Public Policy

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is New York S Estate Tax Cliff 2021 Round Table Wealth

What S New In 2022 Gift And Estate Tax Exemption Updates Cerity Partners

New Estate And Gift Tax Laws For 2022 Youtube

It May Be Time To Start Worrying About The Estate Tax The New York Times

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)