does tennessee have inheritance tax

This includes businesses with a physical location in the state as well as out-of-state businesses performing certain activities in the state. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

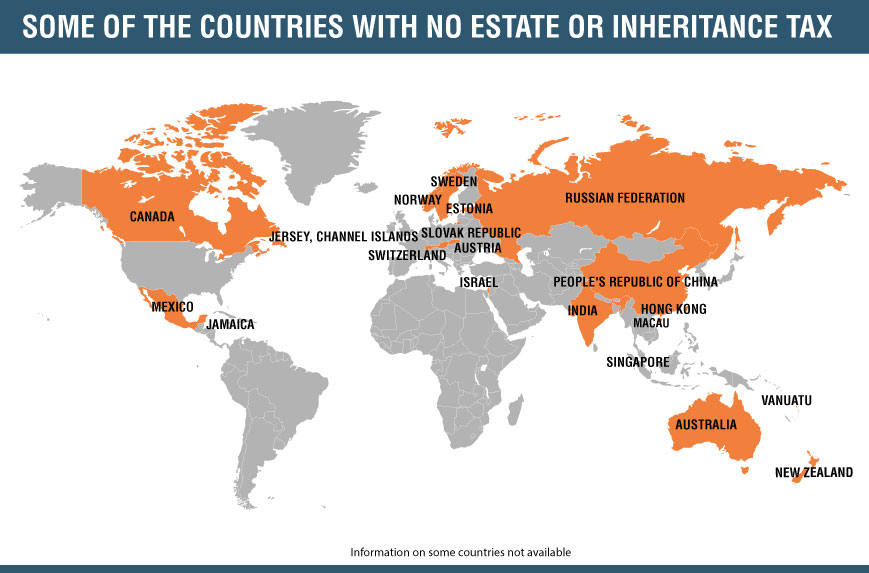

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Our network attorneys have an average customer rating of 48 out of 5 stars.

. Twelve states and Washington DC. Impose estate taxes and six impose inheritance taxes. State tax ranges from business and sales tax to inheritance and gift tax.

Then multiply the product by the tax rate. As of 2022 they include. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. As Tennessee does not have an income tax all forms of retirement income are untaxed at the state level. Tennessee has no inheritance tax and its estate tax expired in 2016.

Tennessees tax on alcoholic beverages is 440 per gallon of spirits and 121 per gallon of wine. Passing on a home. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the baseline rates until 2025 when the tax will be fully eliminated.

It does have however a flat 1 to 2 tax rate that applies to income earned from interest and dividends. When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up to 5 days early. To pay taxes you may do so online at https.

The rest of the states all impose a sales tax that ranges from 55 to Californias 725. Maryland is the only state to impose both. Probate The legal process in which the distribution of property is overseen by a court after the death of the owner.

Beer faces both an excise tax of 3650 per barrel and a wholesale rate of 15 which totals 129 per gallon. When someone dies their estate goes through a legal process known as probate. Beneficiaries Heirs and Inheritors The terms used to refer to an individual or group of individuals who can legally inherit according to the law or a will.

In 2021 rates started at 108 percent while the lowest rate in 2022 is 116 percent. This includes Social Security and income from retirement accounts. Thats the highest beer tax in the nation.

Therefore the Tennessee income tax rate is 0. Get the right guidance with an attorney by your side. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

Tennessee Inheritance and Estate Tax. Estimating the time it takes to get a divorce includes factors such as where you live if your state has a cooling off period or required period of. How to File a.

Being a beneficiary of an estate means carrying the responsibility of paying inheritance tax in certain states but Texas repealed state inheritance tax in 2015. The executor will also pay the creditors as their claims are received. When it comes to inheriting assets it is important to have an understanding of the terms below.

A number of other significant back-and-forth changes have occurred in the millennium. They may need to sell off some assets to have enough cash to pay the outstanding debts including medical bills and credit card bills. Business tax consists of two separate taxes.

Calculate Your Retirement Taxes in These Other States. LZ Tax Services. The state business tax and the city business tax.

Because the state is free of inheritance tax heirs to an inheritance wont be taxed on it. Attorneys with you every step of the way. Thirteen states impose taxes of 5 of the purchase price or less including five states where the tax is just 4.

A legal document is drawn and signed by the heir waiving rights to. To calculate your property tax multiply the appraised value by the assessment ratio for the propertys classification. With a few exceptions all businesses that sell goods or services must pay the state business tax.

Virginia Retirement Tax Friendliness. Other Death Tax Changes by State. Get your tax refund up to 5 days early.

Tennessee repealed its estate tax in 2016. For more information contact your local assessor of property or visit the Tennessee Comptroller of the Treasurys Division of Property Assessments. Most states that have an inheritance tax will exempt very close relatives and sometimes the deceased will indicate in their will that they want the estate to cover this.

Attorneys with you every step of the way. People you give gifts to might have to pay Inheritance Tax but only if you give away more than 325000 and die within 7 years. Beneficiaries and heirs will pay any federal or state impose inheritance tax once their inheritance is disbursed.

If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be. Among states that do have a sales tax some are less significant than others.

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Tennessee Income Tax Calculator Smartasset

Proposed Inheritance Tax Changes Would Be Devastating For Family Farms Study Shows Spudman

Estate Planning Tax Rule You Should Know Batsonnolan Com

Create A Living Trust In Tennessee Legalzoom

Do I Pay Tax On Inherited Assets

The Best States And Towns For Retirement 2021 Tennessee And Texas Advance Topretirements

Do I Pay Tax On Inherited Assets

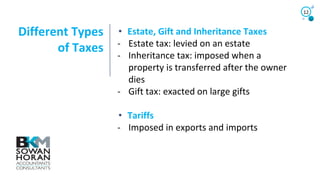

Bkmsh Sources Of Federal Taxes And How The Government Uses It

Estate Gift And Inheritance Tax Exemptions E File Com

Is The Death Tax Killing American Family Farms Fortune

3 Reasons Why Almost Every State Except Nebraska Ended Its Inheritance Tax

Executor Of Estate Master Guide Duties And How To Succeed

Why Chattanooga Tennessee Is A Great Place To Retire Kiplinger

Moving Toward More Equitable State Tax Systems Itep

Do I Pay Tax On Inherited Assets